Roche Pharma Day 2025 — CHF24bn Pharma, Obesity Push, and R&D Acceleration

Roche’s Pharma Day 2025 showcased CHF24bn HY sales, 17 blockbusters, and an R&D Excellence program that fast-tracks priority assets — with obesity (CT-388, petrelintide), neurology (trontinemab, prasinezumab) and oncology bispecific combos the top strategic bets.

Roche’s Pharma Day 2025 in London (Sept 22) showcased a bold vision for sustained growth through 2030, blending financial strength, a robust pipeline, and a transformative push into obesity, neurology, and cardiovascular, renal, and metabolism (CVRM) diseases. With the global obesity epidemic affecting over 1 billion people, Roche is positioning itself as a top-3 obesity player by 2030. Beyond metabolism, neurology and a new “R&D Excellence” model are critical growth pillars.

1. Solid Growth and Financial Discipline

- A Decade of Success: Roche delivered a +5% CAGR (CER) Pharma sales growth from 2015–2024, anchored by 17 blockbusters (e.g., Venclexta with AbbVie).

- HY 2025 Performance: Pharma sales reached CHF 24 billion (+10% YoY CER), driven by Neurology (+17%), Oncology/Hematology (+10%), and emerging CVRM. Core operating profit margin improved to 52.2% (+1.7pts) with +15% sales volume growth (Slide 13).

- Outlook: Roche’s diversified on-market portfolio supports growth through 2028; no major patent cliffs are looming. Diagnostics continues mid- to high-single digit growth.

2. Ten-Year Pharma Ambition: On Track

- Goal: Deliver 20 transformative medicines by 2029 in high-burden diseases; 80% of pipeline targets are “best-in-disease” (BID).

- Progress (2023–H1 2025): 10 medicines launched, +55% avg. peak sales per pipeline project, +40% more patients treated, and 67% of late-stage projects have BID potential.

- R&D Focus: 55% of NMEs are “post-Bar” (entered after 2023), with 8 advancing to Phase III in 2025 (CT-388 for obesity, zilebesiran for hypertension, giredestrant in HR+ breast cancer).

3. On-Market Portfolio: Diversified and Growing

- Oncology/Hematology (CHF 12.1bn, +10%): HER2+ breast cancer franchise peaking in 2026; hematology strong with Polivy, Columvi, Lunsumio; Hemlibra dominates Hemophilia A (>30,000 patients globally).

- Neurology (CHF 4.9bn, +17%): Ocrevus is the global standard in MS (420,000 patients); Evrysdi maintains SMA leadership.

- Immunology (CHF 3.3bn, +14%): Xolair expands into food allergy; Gazyva filed in lupus nephritis.

- Ophthalmology (CHF 2.1bn, +7%): Vabysmo gains share in retinal diseases.

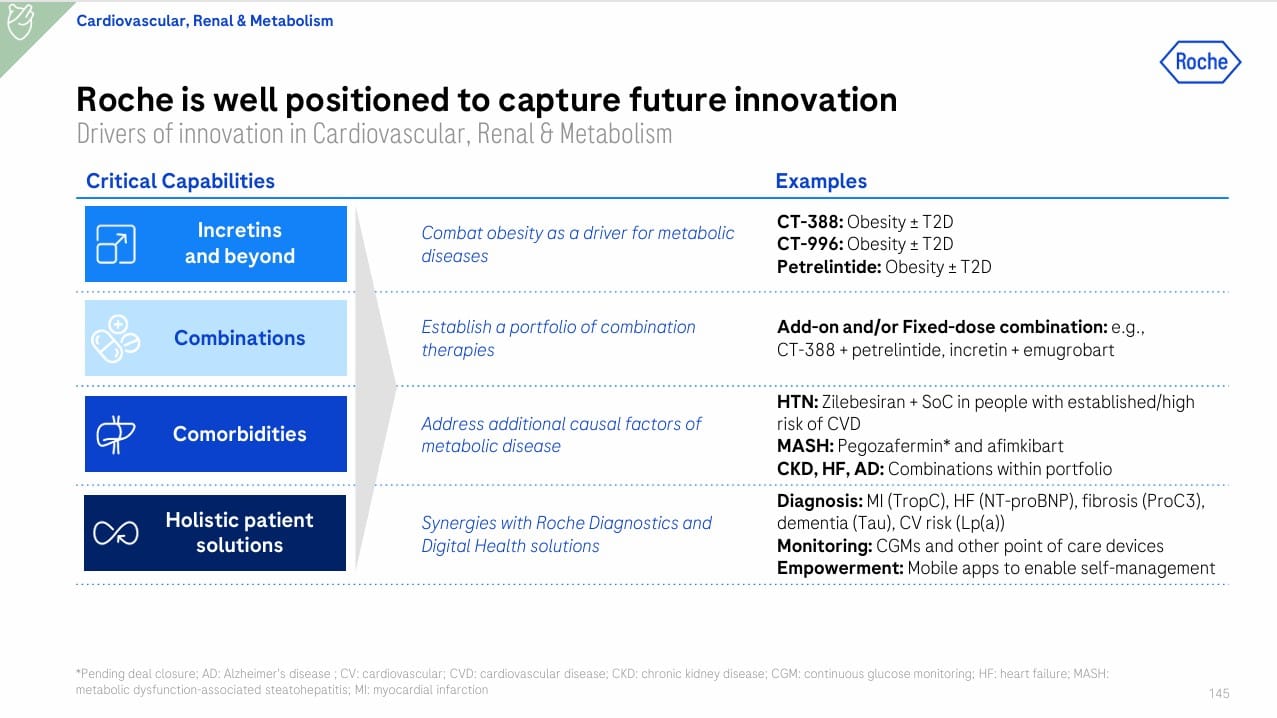

- CVRM: Emerging powerhouse with incretin/amylin portfolio (detailed below).

4. Deep Dive: Obesity Strategy — Roche’s Game-Changer

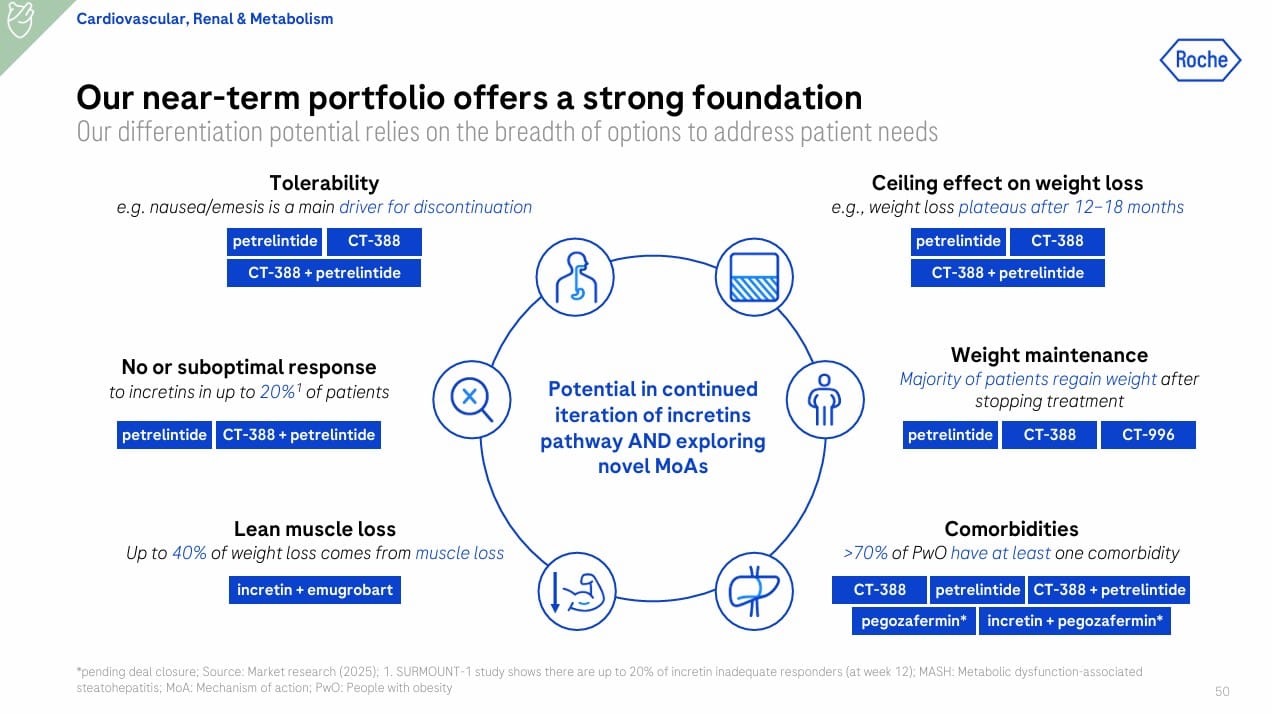

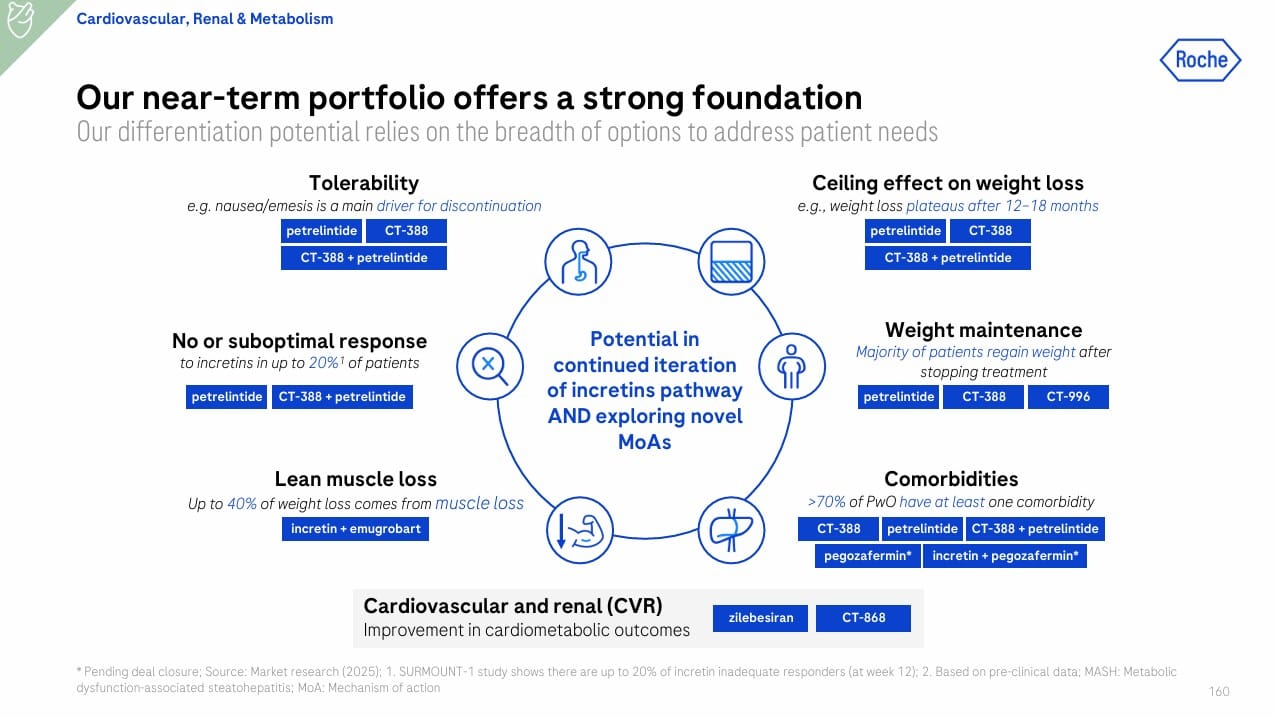

Roche is tackling the 1B+ global obesity epidemic with a patient-centric strategy that targets unmet needs unmet by semaglutide/tirzepatide: weight regain, plateau effect, non-response, tolerability, and muscle loss (Slide 50).

Near-Term Portfolio:

- CT-388 (biased GLP-1/GIP agonist, weekly injectable): Phase II ongoing; Ph I showed ~19% weight loss at 24 weeks, robust glycemic control, and 86% with >30% liver fat reduction.

- Petrelintide (long-acting amylin analog, weekly): Phase II topline expected H1 2026; Ph I showed 8.6% weight loss at 16 weeks with better muscle preservation.

- CT-388 + Petrelintide: Combo Phase II starting Q4 2025 for deeper, sustained weight loss.

- CT-996 (oral GLP-1 RA): Phase II ongoing; Ph I showed 7.3% weight loss in 4 weeks, good tolerability.

- Incretin + Emugrobart (myostatin inhibitor): Phase II GYMINDA readout in 2026; aims to counteract muscle loss.

- Zilebesiran (RNAi for hypertension) and CT-868 (GLP-1/GIP for T1D adjunct) extend CVRM reach.

Strategic BD Addition: 89bio / Pegozafermin Acquisition

- In September 2025, Roche entered a definitive merger agreement to acquire 89bio, bringing its Phase III FGF21 analog, pegozafermin, into Roche’s CVRM portfolio.

- Deal value: $2.4B cash at closing, up to $3.5B including contingent value rights (CVRs) tied to milestones (first commercial sale in F4 MASH, global sales targets).

- Clinical profile: Anti-fibrotic + anti-inflammatory FGF21 analog for moderate-to-severe MASH (F2–F4 fibrosis).

- Strategic rationale: Adds best-in-disease potential in MASH, synergizes with CT-388, petrelintide, and other CVRM assets, and supports combination development (obesity + liver/metabolic disease).

Roche’s CVRM portfolio now includes both internal assets (CT-388, petrelintide, CT-996) and acquired Phase III FGF21 therapy (pegozafermin), addressing obesity, MASH, and metabolic comorbidities.

5. Deep Dive: Neurology — Building the Next Franchise

Neurology was a standout in Roche’s HY25 performance (+17%). Beyond Ocrevus and Evrysdi, Roche is advancing trontinemab (AD) and prasinezumab (PD) as fast-track programs (Slide 75).

- Trontinemab (RG6102): Brain shuttle-enabled Alzheimer’s therapy; fast-tracked into late-stage development.

- Prasinezumab (RG7935): α-synuclein antibody in Parkinson’s, moving toward registrational trials.

- Fenebrutinib: BTK inhibitor in MS, Phase III readout expected 2025.

6. Deep Dive: R&D Excellence & Fast-Track Model

Roche emphasized a new R&D Excellence framework to accelerate high-impact assets (Slides 60, 75):

- Portfolio reprioritization: focus resources on BID projects.

- Fast-track acceleration: trontinemab (AD), CT-388 (obesity), afimkibart (IBD).

- BD integration: 17 deals since 2024 fuel pipeline across CVRM, immunology, and oncology.

- Cycle-time gains: earlier readouts, accelerated Phase II→III transitions.

7. Pipeline Acceleration & 2025–2026 Newsflow

- 2025 Key Readouts: giredestrant (HR+ breast cancer), fenebrutinib (MS), vamikibart (uveitic macular edema), zilebesiran (hypertension), CT-868 (T1D).

- 2026 Milestones: divarasib (NSCLC), petrelintide (obesity), multiple Phase III starts.

Strategic Takeaways

- Roche is doubling down on obesity/CVRM, now with the 89bio FGF21 acquisition strengthening MASH/metabolic capabilities.

- Neurology is emerging as the next growth franchise — Alzheimer’s, Parkinson’s, and MS programs are fast-tracked.

- Oncology remains the stable revenue bedrock, with HER2, ADCs, and bispecifics.

- R&D Excellence / fast-track provides Roche with a scalable operational advantage.

References

- Roche Pharma Day 2025 presentation (Sept 22, 2025, London). Slides cited: 50, 145, 160.

- Roche press release: Roche enters into definitive merger agreement to acquire 89bio, Sept 17–18, 2025.