China’s Biotech Boom: Top Outbound Deals Signal Global Innovation Leadership

Witness the new era of global biotech collaboration as China's top outbound deals inject billions into innovation. From 3SBio's $1.25B Pfizer licensing to BioNTech's acquisition of Biotheus, explore key themes in bispecifics, ADCs, and strategic partnerships.

In recent years, Chinese biotech companies have emerged as major innovators on the global stage, evidenced by a surge in high-value outbound licensing and acquisition deals with leading international pharmaceutical companies. The top 10 Chinese biotech outbound deals by upfront payment — collectively worth billions — demonstrate both the strength of China’s R&D capabilities and its growing integration into the worldwide pharmaceutical ecosystem.

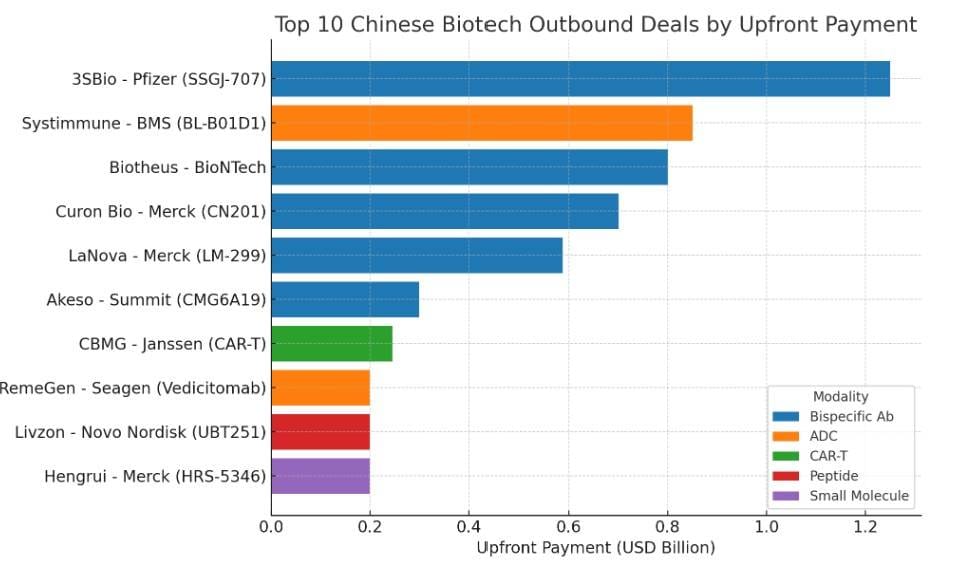

Bar Chart: Top 10 Chinese Biotech Outbound Deals by Upfront Payment

Horizontal ranking of the top 10 deals by upfront payment, color-coded by modality. Highlights the mega-deal by 3SBio-Pfizer at $1.25B.

Top 10 Chinese Biotech Outbound Deals by Upfront Payment (Ranked)

|

Rank |

Drug/Asset |

Chinese Company |

Partner Company |

Deal Type |

Target(s) |

Modality |

Upfront Payment |

Announcement Date |

|

1 |

SSGJ-707 |

3SBio |

Pfizer |

Licensing |

PD-1 / VEGF |

Bispecific Ab |

$1.25B |

2025-05-20 |

|

2 |

BL-B01D1 |

Systimmune (Biokin subsidiary) |

Bristol-Myers Squibb (BMS) |

Licensing |

EGFR / HER3 |

ADC |

$850M |

2023-12-12 |

|

3 |

BNT327 / PM8002 |

Biotheus |

BioNTech |

Acquisition |

PD-L1 / VEGF-A |

Bispecific Ab |

$800M |

2024-11 |

|

4 |

CN201 |

Curon Biopharma |

Merck & Co. |

Licensing |

CD3 / CD19 |

Bispecific Ab |

$700M |

2024-08-09 |

|

5 |

LM-299 |

LaNova Medicines |

Merck & Co. |

Licensing |

PD-1 / VEGF |

Bispecific Ab |

$588M |

2024-11-14 |

|

6 |

CMG6A19 |

Akeso Biopharma |

Summit Therapeutics |

Licensing |

CD20 / CD19 / CD3 |

Bispecific Ab |

$300M |

2024-10-29 |

|

7 |

C-CAR039 & C-CAR066 |

Cellular Biomedicine Group (CBMG) |

Janssen (Johnson & Johnson) |

Licensing |

CD19 / CD20 |

CAR-T |

$245M |

2023-05-02 |

|

8 |

Vedicitomab |

RemeGen |

Seagen |

Licensing |

HER2 |

ADC |

$200M |

2023-05-02 |

|

9 |

UBT251 |

Livzon Pharma |

Novo Nordisk |

Licensing |

GLP-1 / GIP / GCGR |

Peptide agonist |

$200M |

2021-08-08 |

|

10 |

HRS-5346 |

Hengrui Medicine |

Merck & Co. |

Licensing |

Lp(a) |

Small molecule |

$200M |

2025-03-25 |

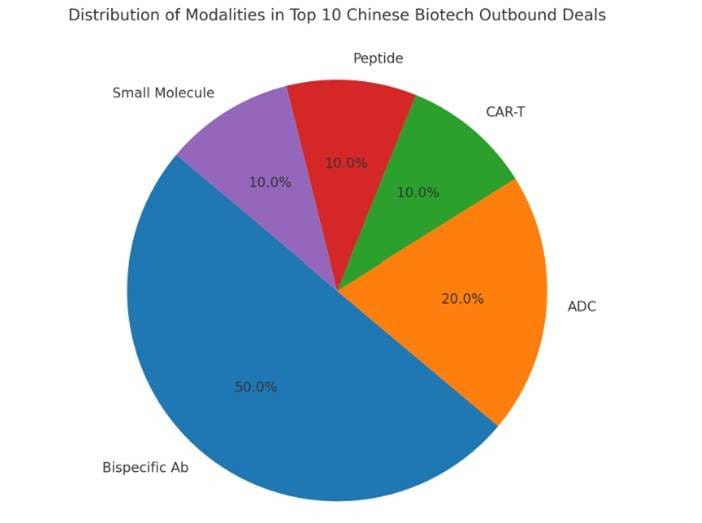

Pie Chart: Distribution of Modalities in Top 10 Deals

Modalities distribution among top 10 deals: Bispecific antibodies dominate (50.0%), followed by ADCs (20.0%), CAR-T (10.0%), peptides (10.0%), and small molecules (10.0%).

Strategic Analysis: Key Themes & Insights

1. China’s Rising Role in Global Biopharma Innovation

The sheer magnitude of these deals — with multiple upfronts exceeding hundreds of millions — signifies China’s evolution from a generics hub to an innovation leader. Partnerships with industry titans like Pfizer, BMS, Merck, BioNTech, and Janssen reflect strong global confidence in Chinese biotech pipelines.

2. Immuno-Oncology Dominates the Innovation Landscape

Targets in immuno-oncology, particularly bispecific antibodies and CAR-T therapies focusing on PD-1, PD-L1, VEGF, CD3, CD19, and CD20, dominate the top deals. This aligns with global trends emphasizing immune modulation and targeted therapies as the future of cancer treatment.

3. Diverse Modalities Signal Broad Expertise

Beyond bispecifics and CAR-T, antibody-drug conjugates (ADCs), peptides, and small molecules illustrate China’s versatile biotech capabilities. Notably, ADCs like BL-B01D1 and Vedicitomab underscore China’s growing technical sophistication in complex biologics.

4. Licensing Prevails with Strategic Acquisitions Emerging

Most deals are licensing agreements, allowing Chinese firms to retain some control while leveraging global commercialization strengths. The BioNTech-Biotheus acquisition shows an increasing trend of outright purchases for strategic vertical integration.

5. Robust Capital Influx Fuels Innovation and Expansion

These high-value deals inject significant capital into Chinese biotech firms, accelerating clinical development, scaling manufacturing, and expanding global regulatory reach — key factors for sustaining growth.

Spotlight Highlights

1. 3SBio & Pfizer: Breaking Records with $1.25 Billion Licensing Deal

Leading the pack, this deal for the PD-1/VEGF bispecific antibody SSGJ-707 marks a milestone in China’s outbound licensing, showcasing the country’s advanced capabilities in next-gen immunotherapies.

2. Systimmune/Biokin & BMS: Pioneering ADC Innovation

The $850 million upfront for EGFR/HER3-targeting ADC BL-B01D1 demonstrates how Chinese subsidiaries are successfully developing sophisticated biologics with blockbuster potential.

3. BioNTech’s $800 Million Acquisition of Biotheus

This acquisition reveals a strategic shift toward integrating promising Chinese bispecific antibody technologies to compete with global PD-1 inhibitors, strengthening BioNTech’s oncology pipeline.

4. Cellular Biomedicine Group & Janssen’s CAR-T Partnership

With a $245 million upfront, this licensing deal for C-CAR039 and C-CAR066 highlights China’s growing footprint in cell therapy innovation targeting hematological malignancies.

5. Merck’s Multi-Asset Engagement

Merck’s deals with Curon Biopharma, LaNova Medicines, and Hengrui Medicine showcase a broad and diversified investment strategy in Chinese innovation, spanning immuno-oncology and cardiovascular targets.

Conclusion

The top 10 Chinese biotech outbound deals reflect a new era of biopharmaceutical innovation — where China is no longer a passive participant but a key driver of cutting-edge drug development. As Chinese companies increasingly partner with, or become part of, global pharma, the future of medicine stands to benefit from a truly collaborative and international innovation ecosystem.

The strength and diversity of these deals mark a significant step in China’s journey from “the world’s factory” to a global leader in biopharmaceutical research and development, ultimately delivering novel therapies to patients worldwide.

Sources

- SystImmune and Bristol Myers Squibb Announce a Global Strategic Collaboration Agreement for the Development and Commercialization of BL-B01D1. Bristol Myers Squibb, 2023 (accessed Aug 25, 2025).

- Bristol Myers pays $800M upfront for antibody-drug conjugate. FierceBiotech, 2023 (accessed Aug 25, 2025).

- The United Laboratories and Novo Nordisk announce exclusive license agreement for UBT251, a GLP-1/GIP/glucagon triple receptor agonist. GlobeNewswire, 2025 (accessed Aug 25, 2025).

- Novo Nordisk Secures Triple Agonist UBT251 in $2B Deal. Contract Pharma, 2025 (accessed Aug 25, 2025).

- 2024 Interim Akeso Corporate Presentation. Akeso Biopharma, 2024 (accessed Aug 25, 2025).

- Also Expands License Territories for Ivonescimab. Summit Therapeutics, 2024 (accessed Aug 25, 2025).

- Seagen and RemeGen Announce Exclusive Worldwide License and Co-Development Agreement for Disitamab Vedotin. BusinessWire, 2021 (accessed Aug 25, 2025).

- Seagen Strikes $2.6 Billion ADC Deal with China's RemeGen. BioSpace, 2021 (accessed Aug 25, 2025).

- Pfizer Completes Licensing Agreement with 3SBio. Pfizer, 2025 (accessed Aug 25, 2025).

- Pfizer Enters into Exclusive Licensing Agreement with 3SBio. Pfizer, 2025 (accessed Aug 25, 2025).

- BioNTech to Acquire Biotheus to Boost Oncology Strategy. BioNTech, 2024 (accessed Aug 25, 2025).

- BioNTech boosts oncology pipeline with China buy. Nat. Biotechnol., 2024 (accessed Aug 25, 2025).

- Merck Enters into Exclusive Global License for LM-299, An Investigational Anti-PD-1/VEGF Bispecific Antibody from LaNova Medicines Ltd. Merck, 2024 (accessed Aug 25, 2025).

- Merck pays $588M for bispecific to defend Keytruda's kingdom from emerging threat. FierceBiotech, 2024 (accessed Aug 25, 2025).

- Merck to Acquire Investigational B-Cell Depletion Therapy, CN201, from Curon Biopharmaceutical. Merck, 2024 (accessed Aug 25, 2025).

- Merck Completes Acquisition of Investigational B-Cell Depletion Therapy, CN201, from Curon Biopharmaceutical. Merck, 2024 (accessed Aug 25, 2025).

- Janssen Enters Worldwide Collaboration and License Agreement with Cellular Biomedicine Group to Develop Next Generation CAR-T Therapies. Johnson & Johnson, 2023 (accessed Aug 25, 2025).

- Cellular Biomedicine Group Announces Exclusive Collaboration and License Agreement with Janssen to Develop and Commercialize Anti-CD19 & CD20 Bi-Specific and Anti-CD20 CAR-Ts for Non-Hodgkin Lymphoma. PRNewswire, 2023 (accessed Aug 25, 2025).

- Merck Enters Exclusive License Agreement for HRS-5346, an Investigational Oral Lipoprotein(a) Inhibitor for Cardiovascular Disease from Jiangsu Hengrui Pharmaceuticals Co. Ltd. Merck, 2025 (accessed Aug 25, 2025).

- Merck Reaches Licensing Agreement with Jiangsu Hengrui for Novel Heart Disease Drug. Pharm. Exec., 2025 (accessed Aug 25, 2025).