China Approves Boyouping® (BA5101), the World’s First Dulaglutide Biosimilar and First Domestic Product

China’s NMPA approved Boyouping® (BA5101), the world’s first dulaglutide biosimilar and first domestic product for type 2 diabetes. Developed by Boan Biotech and commercialized by Shanghai Pharma, Boyouping® matches Eli Lilly’s Trulicity® in efficacy and safety, with plans for global expansion.

Key Points

- On August 8, 2025, the NMPA approved Boyouping® (BA5101/LY05008), the world’s first dulaglutide biosimilar, developed by Shandong Boan Biotechnology Co., Ltd. under Luye Pharma Group.

- No other domestic dulaglutide injections have reached the BLA stage in China.

- Commercialization will be handled by Shanghai Pharmaceuticals Holding Co., Ltd. (Shanghai Pharma).

- Core sequence patents for dulaglutide in China expired in June 2024; one formulation patent remains valid until December 2025.

- The approval positions Boan Biotech as a leader in China’s GLP-1 biosimilar market, with global expansion underway.

Approval Overview & Strategic Collaboration

On August 8, 2025, China’s National Medical Products Administration (NMPA) approved Boyouping® (BA5101/LY05008) for glycemic control in adults with type 2 diabetes mellitus (T2DM). Developed by Boan Biotech, a Luye Pharma subsidiary, Boyouping® is the first and currently only approved biosimilar to Eli Lilly’s Trulicity® (dulaglutide) worldwide.

Shanghai Pharma will lead mainland commercialization, leveraging a distribution network covering more than 70,000 medical institutions in 25 provinces.

Clinical and Regulatory Significance

Dulaglutide is a once-weekly long-acting GLP-1 receptor agonist with demonstrated benefits in glycemic control, weight loss, cardiovascular risk reduction, and renal protection, with a low risk of hypoglycemia.

Boyouping®’s development program included:

- Phase 1 PK similarity study (Expert Opinion on Biological Therapy, 2023) showing matched pharmacokinetics with reference dulaglutide in healthy volunteers.

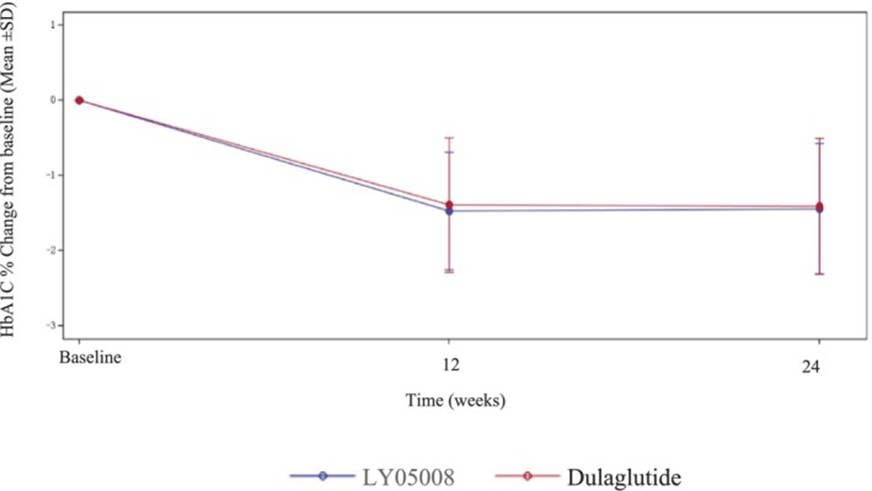

- Phase 3 trial (Journal of Diabetes, 2025) in 440 Chinese adults with T2DM, demonstrating equivalence in HbA1c reduction at 24 weeks: −1.44% (Boyouping®) vs. −1.41% (Trulicity®) [LSMD 0.06%, 95% CI −0.08 to 0.19], with comparable weight loss (−2.68 kg vs. −2.42 kg), fasting plasma glucose, safety, PK, and immunogenicity profiles.

Common adverse events were mild to moderate, mainly gastrointestinal, with hypoglycemia incidence of 0.9% for Boyouping® vs. 3.7% for Trulicity®.

Patent Landscape

According to the China Drug Patent Information Platform, two core sequence patents for dulaglutide expired on June 10, 2024. A formulation patent is expected to expire on December 15, 2025.

Some media reports reference a 2026 expiry, but these likely pertain to non-core secondary patents or international filings.

Development and Market Context

China is home to the largest diabetes population worldwide, with 148 million adults living with T2DM in 2024, projected to reach 168 million by 2050. The Chinese GLP-1 market was valued at approximately RMB 6.38 billion in 2024.

Globally, Trulicity® generated around USD 5.25 billion in sales in 2024, down from prior years due to competition from newer GLP-1 therapies like tirzepatide.

Boyouping® leads a global race of six dulaglutide biosimilars in development, ahead of candidates from Lepu Medical and Beijing SL Pharmaceutical. The FDA has cleared Boyouping® for U.S. clinical trials, supporting Boan’s international ambitions.

Company Positioning

Boan Biotech has been managing debt pressures (RMB 2.02 billion in cash equivalents, RMB 3.96 billion in loans at end-2023) while narrowing losses through cost efficiencies and biosimilar revenues, including Boyounuo® (bevacizumab) and Boyoubei® (denosumab).

Recent NMPA approvals include Boluoja® (denosumab for giant cell tumor of bone). Pipeline highlights include PR202 (GLP-1R/GIPR dual-target ADC for weight loss) and BA2101 (anti-IL-4Rα mAb).

Partnerships—such as with Shanghai Pharma for Boyouping®—reinforce Boan’s market execution strength.

Strategic Implications

Boyouping®’s approval underscores China’s increasing capacity to develop biosimilars to global blockbusters, expanding patient access and affordability. With Trulicity® approaching patent expiry and market share shifting toward next-generation GLP-1 agents, dulaglutide biosimilars are poised to intensify competition in China’s diabetes market and, in time, position domestic players for selective international entry.

Global Competitive Landscape

Globally, Eli Lilly’s incretin portfolio has shifted from dulaglutide (Trulicity) to tirzepatide—marketed as Mounjaro for type 2 diabetes and Zepbound for obesity—which has become the company’s largest revenue driver. According to Lilly’s latest 2025 Q2 earnings report, tirzepatide sales surpassed USD 3.6 billion in the first half of 2025 alone, reflecting strong market uptake and growth momentum. While Trulicity remains a multi-billion-dollar product, its growth has slowed amid GLP-1/GIP competition and looming U.S. (2027) and EU (2028) patent expiries, with its sales declining as tirzepatide rapidly expands in the GLP-1/GIP dual-agonist market.

Biosimilar developers in India, Korea, and Europe, including Samsung Bioepis, Biocon, and Sandoz, are aligning regulatory timelines with these expiries. Novo Nordisk continues to dominate with semaglutide (Ozempic/Wegovy) while advancing CagriSema. Globally, originators are shifting toward multi-agonists and oral formulations—a trend that may delay dulaglutide biosimilar uptake in major markets but could open cross-border licensing and importation opportunities for Chinese companies post-2030.

Sources

- Hertle C, Gerstein HC, Colhoun HM, et al. Dulaglutide and cardiovascular outcomes in type 2 diabetes (REWIND): a double-blind, randomised placebo-controlled trial. Lancet. 2019;394(10193):121–130. doi:10.1016/S0140-6736(19)31149-3.

- Dulaglutide Injection Package Insert. Eli Lilly and Company.

- Zhang Q, et al. Pharmacokinetic similarity study comparing the biosimilar candidate LY05008 with its reference product dulaglutide in healthy Chinese male subjects. Expert Opin Biol Ther. 2023;23(8):727-735. doi:10.1080/14712598.2023.2189009.

- Liu L, et al. Efficacy and Safety of Dulaglutide Biosimilar LY05008 Versus the Reference Product Dulaglutide (Trulicity) in Chinese Adults With Type 2 Diabetes Mellitus: A Randomized, Open-Label, Active Comparator Study. J Diabetes. 2025;17(4):e70077. doi:10.1111/1753-0407.70077.

- International Diabetes Federation. IDF Diabetes Atlas. 2025.

- Eli Lilly and Company. 2024 Annual Report.

- HKEX News. Boan Biotech Announcements. August 8, 2025.

- Boan Biotech Press Release. Boyouping® Approval in China. August 8, 2025.

- Center for Biosimilars. Dulaglutide Biosimilar LY05008 Shows Efficacy and Safety.

- PharmCube. Dulaglutide Patent Information.

- Jiemian News. Boan Biotech’s Dulaglutide Approval Report. August 2025.

- Economic Reference News. GLP-1 Market Analysis. July 2025.

- Eli Lilly and Company. Q2 2025 Earnings Report.